Introduction

It is a pleasure to be here at the Reserve Bank of India and to follow so many distinguished economists in giving this year’s L.K. Jha Memorial Lecture.

It has been six years since I was last in India and more than 15 since I first came. The changes have been remarkable – in the economy, in the financial system, in education and health care – and as a consequence, there has been vast improvement in the lives of literally hundreds of millions of people. And the change in India’s relations with the United States has been a profoundly positive development – one that I hope and trust will prove lasting.

This all is a tribute to many people and many things. Thinking back to that moment in the summer of 1991 when India was on the brink, it is a tribute to the resolute determination and extraordinary wisdom of those who have guided India’s finances. It is a tribute to this great institution, the Reserve Bank of India. And it is a tribute to successive Indian governments and to the enormous thoughtfulness of Indian economic discourse on almost every subject.

As remarkable as developments in India have been, they are not my primary subject this evening. Instead, I want to focus on some implications – both positive and normative – of what is to me the most surprising development in the international financial system over the last half dozen years. That development is the large flow of capital from the world’s most successful emerging markets to the traditional industrial countries, and the associated enormous buildup of reserves in the developing world. To my knowledge it was neither predictable nor predicted and the implications are large and have not yet fully been thought through.

The Current Global Capital Flows Paradox

Three aspects of global financial flows stand out as being without precedent:

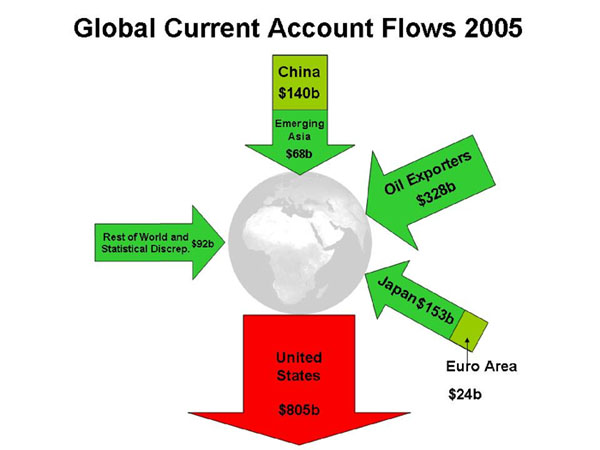

First, the net flow of capital is substantially from developing countries and emerging markets towards the industrialized world and principally the United States, as the world’s greatest power, is the world’s greatest borrower. Figure 1 depicts global current account balances as estimated for 2005. It is apparent that the United States is an overwhelming absorber of global savings while the rest of the world is a supplier of global savings. While the combined current account surpluses of Japan and the non-European industrialized countries represents about 35 percent of U.S. net international borrowing, the remainder is financed overwhelmingly by emerging markets and oil exporting countries. This broad pattern, which has been going on for several years now and on current projections will continue for quite some time, runs very much counter to the traditional idea that core countries export capital to an opportunity rich periphery.

Second, the buildup in U.S. net foreign debt is substantially mirrored in reserve accumulation by emerging markets. While claims flow in many directions, it is noteworthy that a large fraction of the buildup in foreign claims is represented by reserve accumulation. Brad Setser, whose regular web log1 on this topic should be a resource for all concerned about these issues, estimates that global foreign reserves, netting out valuation adjustments increased by $670 billion in 2005, of which Japan accounted for only $15 billion. As Figure 2, drawn from Setser’s work, illustrates, this pattern of substantial foreign reserve accumulation has been underway for several years though there has been a shift from Japanese accumulation of reserves to increased accumulation by oil exporters.

As I shall discuss in substantially more detail later, global reserves of emerging markets are far in excess of any previously enunciated criterion of reserve need for financial protection. Figure 3 uses one familiar criteria, the so-called Guidotti-Greenspan rule that reserves should equal 1 year’s short term debt to demonstrate the spectacular increase in what might be thought of as excess reserves in emerging markets. These reserves have grown from half a trillion dollars in 1999 to over two trillion dollars today. As Table 1 demonstrates, they are distributed quite broadly around the world.

Third, expected real returns on these reserves are very low. Assuming constant real exchange rates, reserves will earn the expected real return on primarily dollar and secondarily euro fixed income assets. Indexed bond yields or comparisons of interest rates and forecasted inflation rates would make 2 percent a somewhat optimistic estimate of expected real returns in international terms. If real exchange rates in emerging markets are likely to appreciate then domestic returns will be even lower and more risky.

These three elements, flow of capital from emerging markets to industrial countries, huge accumulation of reserves, and expected negative returns on reserves constitute what might be called the capital flows paradox in the current world financial system. While borrowing and consuming is functional for the United States and reserve accumulating and exporting is perhaps functional for many other countries, the sustainability and the desirability of the capital flows paradox seems to me to require careful thought. Let me turn first to the American situation.

Unsustainable and Problematic Dependence of the United States on Foreign Capital.

The American current account deficit is unprecedented in our economic history or that of other major economic powers. Today, it is currently running at a rate approaching 7 percent of GDP. Barring some discontinuity, most knowledgeable observers expect it to increase. Imports substantially exceed exports, the dollar appreciated over the last year, the income elasticity of U.S. imports exceeds that of U.S. exports, and so forth. International debt accumulation at these rates cannot go on forever.2

Moreover, most of the classic indicators for deciding how serious a current account deficit are worrying.

- First, 7 percent and growing is an unusually large deficit, as Figure 4 illustrates.

- Second, as Figure 5 illustrates, the current account deficit is financing consumption rather than investment as the U.S. net national savings rate is now at a record low level of under 2 percent.

- Third, investment is tilted towards real estate and the non-traded goods sector rather than the traded goods sector and away from exportables.

- Fourth, the net flow of direct investment is out of the United States and the flow of incoming capital appears to be of shortening maturity and coming increasingly from official rather than private sources.

This configuration, whatever its causes, raises obvious risks. There is the hard-landing risk. This is not just an American risk, but a global risk at a time when the U.S. external deficit is creating nearly an export stimulus demand approaching 2 percent of global GDP. And as we are seeing with increasing frequency, whether it is regarding ports or computers or automobile parts, the current situation is creating substantial protectionist pressures. In addition, it is hard not to imagine that there are geopolitical risks associated with reliance on what might be called a financial balance of terror to assure continued financial flows to the United States. Indeed, I was reminded about the geo-political issues that such dependence posed for the United States when I read recently about the effective American use of exchange rate diplomacy to force the hands of the British and French during the Suez crisis.

To be sure the United States should be viewed differently from an emerging market and so there has been a certain amount of complacent commentary – commentary that has gained in strength as the U.S. current account deficit has continued without evident ill effect. In general, my view thinking about past experience with tech stocks in the United States or with the Japanese stock market or with a range of emerging market situations is that the moment of maximum risk comes precisely when those concerned about sustainability lose confidence in their views as their warnings prove to have been premature and when rationalizations come to the forefront.

I will not reflect at length on the commentaries of the complacent. Suffice it to say that intangible investment as well as tangible investment in the United States has also declined in the United States even as our dependence on foreign capital has increased.3 Even if home bias is declining, there are surely limits on the tolerance of foreign investors for increased claims on the United States. And while arguments about “financial dark matter” or the U.S. ability to issue debt in its own currency probably have some force in thinking about what level of external debt is sustainable for the United States, they surely do not make the case for indefinite continued expansion of debt.

U.S. Adjustment and the Global Economy

The massive absorption of global capital by the United States is of questionable sustainability and if sustainable, of dubious desirability. But the one thing that we all know about markets is that they have two sides and that one cannot understand U.S. borrowing without understanding foreign lending. One cannot understand U.S. deficits without understanding others’ surpluses. And one cannot think through the consequences of reduction in U.S. import led growth without thinking through the consequences for the export led growth of others. Let me turn then to the global economic configuration.

As have been conventional in many international discussions, it is frequently suggested, sometimes even in India, that the U.S. is sucking capital out of the developing countries because of its fiscal deficit. Yet one has to worry about getting what one wishes for in the form of a unilateral U.S. increase in national savings.

There is one striking fact about the global economy that belies a dominantly American explanation for the pattern of global capital flows: real interest rates globally are low, not high. Whether one looks at index bond yields, measures of nominal interest rates relative to ongoing inflation, and yields on most assets, especially real estate or credit spreads, capital market pricing points to the supply of global capital tending to outstrip demand rather than vice versa. Real interest rates globally are low not high from a historical perspective. If the dominant impulse explaining global events was declining U.S. savings, one would expect abnormally high real interest rates, as with the twin deficits in the 1980s, not abnormally low real interest rates. America’s consumption growth in substantial excess of income growth has been matched by substantial export led growth in the rest of the world.

Imagine that somehow through some combination of U.S. policy adjustments, U.S. national savings were to substantially increase resulting in downwards pressure on U.S. interest rates and a sharp reduction in the U.S. current account deficit. The result would be a substantial contractionary impulse to the remainder of the global economy, an effect that would be magnified if other currencies appreciated against the dollar causing a switching of expenditure towards U.S. goods. Moreover, those countries seeking to peg their currencies as U.S. interest rates declined would have to further expand not just their reserves but their rate of reserve accumulation. An unwinding of global imbalances, if it is not to be recessionary for the global economy, thus requires compensatory actions in other parts of the world. What are these actions?

As a matter of arithmetic, any reduction in the U.S. current account deficit must be matched by reductions in current account surpluses or increases elsewhere. If this simply takes place automatically as a consequence of reduced U.S. demand the result will be contractionary on a substantial scale. After all, the U.S. current account deficit represents an impulse of close to 2 percent of GDP to global aggregate demand. What compensatory actions are appropriate? It is conventional to start such a discussion with the industrialized countries. But as Figure 1illustrates, their surpluses offset less than a quarter of the U.S. current account deficit.

Japan at last appears to be recovering, though as is all too traditional, its growth appears to be export led. Unfortunately, given Japan’s fiscal situation and the structural reality of an aging society and shrinking labor force it’s not clear just how much scope there realistically is for a shift to domestic demand led growth.

The situation in Europe is in some ways less clear. Some European policy makers have taken the position that since Europe is in approximate current account balance, it has no major role to play in the global current account adjustment process. They urge U.S. fiscal contraction as a means for reducing the U.S. deficit but do not see any European movement into deficit as part of the global adjustment process. I find this view implausible. As long as there are going to be substantial structural surpluses in the oil exporting countries, it is hard to see why Europe, which is even more dependent on imported oil than the United States, should not be comfortable running at least a modest current account deficit. Moreover there is scope for both microeconomic policies that reduce regulator barriers and macroeconomic policies to increase aggregate demand.

Without the gift of prescience regarding oil prices, it is harder to prescribe for the oil exporting countries. The accumulation of significant current account surpluses in the face of a transitory increase in the price of oil seems rational and appropriate. And the long experience of natural resource exporters, including the experiences of oil exporters during the 1970s, suggest the dangers of being too quick about assuming that price increases will be permanent. There is a likelihood that over the next several years either oil prices will come down or oil exporters’ contribution to global aggregate demand will increase. But in prescribing a path for overall global adjustment, caution is surely in order here.

The net surplus of emerging Asia led by China exceeds the combined surplus of Europe and Japan. And given the magnitude and attractiveness of investment opportunities in emerging Asia it would be natural for it to run a current account deficit. This suggests that the primary source of global demand to offset increases in United States savings should come from the Asian consumer. India is a positive example here. It is noteworthy that consumption represents close to two-thirds of GDP in India, and significantly under one half in China. I will return in a few minutes to the question of reserve accumulation and to the potential for shifting to a more domestic demand led growth strategy in emerging markets.

In addition to the benefits for the global system that a domestic demand led strategy would bring, I suspect a less export oriented strategy would also contribute to ultimate financial stability. Looking back, it seems relatively clear that Japanese economic policy could wisely have supported more consumption sooner and in the process avoided the bubbles in asset prices during the 1980s associated with preventing yen appreciation that created such havoc in their financial system.

The rest of the world is probably not in a position to make large contributions to the global adjustment process. Healthier policy environments in Latin America and Africa would reduce capital flight, tend to increase private capital flows and lead to somewhat larger investment driven current account deficits. Given the current euphoria reflected in emerging market spreads, it would be a mistake for policy makers to cheer this process along too rapidly.

The Opportunity Cost of Excess Global Reserves

So far I have argued first that the U.S. current account deficit is unsustainable and dangerous, and second that managing its decline will require substantial adjustments in other parts of the world if a recession is to be avoided. I want to return now to the question of official reserve accumulation of which I referred to earlier. It is striking to estimate the cost to developing countries of reserve holding that goes beyond what is necessary for financial stability. Even if we used a standard more rigorous than any that has been proposed and treated reserves in excess of twice short-term debt as unnecessary for insurance purposes, these reserves, as shown by Figure 6, represent almost $1.5 trillion and are growing at several hundred billion dollars per year while earning what is likely to be a zero real return measured in domestic terms. This represents a substantial cost. If the wealth tied up in reserves were invested either domestically in infrastructure or in a fully diversified long-term way in global capital markets, 6 percent would not be an ambitious estimate of what could be earned. The resulting gain would be close to $100 billion a year. Aggregating the 10 leading holders of excess reserves, the opportunity cost of these reserves comes to 1.85 percent of their combined GDP.4

As Dani Rodrik has pointed out, this is comparable to the gains thought to be achievable from the next round of trade liberalization, to global foreign aid, or to spending on key social sectors in a number of countries. This idea of an excess of low yielding reserves in the developing world represents a radical departure from the problems that we have traditionally focused on in thinking about the international financial system. From the founding of the IMF to the creation of the SDR through discussions of expanded SDRs during the 1990s, the emphasis was on the need to find low cost ways of manufacturing insurance that reserves could provide capital importing developing nations. It is a very different world when developing nations are accumulating reserves to finance the United States.

Towards a Revised International Financial Architecture

The two new elements in the global financial constellation that I have been stressing – the U.S. current account deficits mirrored primarily by surpluses outside of the traditional industrialized nations, and the staggering accumulation of reserves by emerging market countries, both suggest the obsolescence of the G7/G8 as the dominant forum for international financial discussion. It is neither in a position to discuss many of the most important domestic policy adjustments necessary for global stability nor does it include the largest official suppliers of cross border flows of capital. The G7/G8 finance ministers’ process was started at a time when major issues of global demand and policy coordination involved only the industrial countries – when exchange rate policies were largely a matter of concern between industrial countries and when the only issues involving developing countries were periodic breakdowns in the flow of capital from rich country lenders to poorer country borrowers. None of these premises are currently met.

Any attempt to manage jointly any increase in U.S. savings and an offsetting increase in global demand from global sources will clearly require a forum broader than the G7/G8. So also will any global attempt to think through the implications of the massive reserve accumulation on which I have commented.

Just what process is right for addressing these issues is a delicate and sensitive political question involving aspects that I am no longer close to. There has been an explosion of financial fora involving emerging markets in recent years, including the APEC finance ministers, the Latin American finance ministers, the ASEAN finance ministers and most promisingly, the G20. It may well be the appropriate successor to the G7/G8, though I worry about just how much serious business will get done in a forum with 40 principals. What should not be in doubt is the importance of creating a forum that structurally has political clout over the international institutions and at least some ability to influence domestic policy decisions of individual countries. I would suggest three areas of focus in the next several years:

First and most importantly, the formulation of a global strategy for managing the U.S. current account deficit downwards without excessive risk to global growth. I do not minimize the domestic difficulties in the United States here, nor am I falsely optimistic about the ability of any international forum to influence U.S. fiscal policy. Nonetheless I believe that much more frequent and intense discussions on a multilateral basis than have taken place to date will raise the prospects for a successful adjustment process and reduce the risks of either a hard landing or of dangerous unilateralist responses to current account imbalances.

Second, a new forum should look at the role and governance of the existing international financial institutions in the current environment. Clearly, the influence and governance of the major reserve accumulators need to be increased. More fundamentally, the IMF has always had as its raison d’être addressing imbalances, but its surveillance and indeed its lending has always been focused on those who are borrowing excessively. I used to quip that IMF stood for “It’s Mostly Fiscal,” though the fund’s work in recent years has expanded much more broadly. But it must be acknowledged that the energy it devotes to current account deficits that need to be adjusted downwards dwarf the energy it addresses to current account surpluses that need to decline to facilitate smooth global adjustment or the energy it devotes to encouraging current account deficits where these can finance either consumption on attractive terms or productive investments.

In a similar vein, the IMF has perhaps been too reluctant to criticize the exchange rate policies of its members. When exchange rates are overvalued, the IMF does not point it out publicly for fear of creating a panic. When exchange rates are undervalued, the IMF often does not see financial problems for the country in question and so does not raise an alarm. It has always struck me as ironic that the IMF, which is charged with maintaining the global financial system and therefore should be particularly focused on policy choices that affect multiple countries, is prepared to address domestic monetary and fiscal policy choices, which while they may have international ramifications are primarily of domestic concerns, but is so reticent about addressing exchange rate issues which by their very nature are multilateral. It is unlikely that the IMF will take on this role alone and so will very much need the encouragement of its major shareholders.

Third, the group should take up the question of deploying the reserves of developing countries. There are of course the questions that are much discussed of the potential implications for the international financial system of shifts in the composition of currencies in which reserves are held. This is obviously a sensitive subject for everyone, but as long as the ex ante returns on dollar assets and euro assets are relatively close together it may not be a matter of welfare significance.

Of greater concern is the risk composition of the assets in which reserves are invested. When reserves were held at levels that represented self-insurance against possible financial crisis, the case for their investment in maximally liquid, maximally safe form was compelling. When reserves are far greater there would seem to be a case for more aggressive investment either in support of imports that have a high social return or in a much richer menu of international assets.

By investing in a global menu of assets U.S. institutions have earned substantial real returns over the years. Indeed the average large higher education U.S. endowment fund has earned a real return approaching 10 percent over the last decade or two. It is natural to ask whether the excess national reserves of emerging markets should not be invested with an aspiration in this direction.

If India, for example, were to follow this course, the result would be extra returns that would amount to between 1 and 1-1/2 percent of GDP each year. This figure, which dwarfs the seigniorage considerations that traditionally played so large a role in monetary theory, represents an amount greater than the Indian public sector spends on health care each year. Annuitized and valued as a stock, it is comparable to 40 percent of the market value of all the traded stocks on the Bombay Exchange. And India is not an extraordinary case. Reserves as a share of GDP are actually very substantially larger in China, in Taiwan, in Russia, and in Thailand than in India.

In principle, decisions about reserve investment can be made domestically. But I suspect that there are at least two important roles for international discussion and coordination. There are important risks for any central bank that attempts to go in this direction. It is likely to reap much more disfavor in years where investments go badly than favor in years when investments go well. And the opportunities for mischief in picking assets, in exercising control rights, in misvaluing assets are likely to be very large. Some form of legitimated international scrutiny and monitoring of central bank reserve investments could help to overcome these problems.

Perhaps it is time for the IMF and World Bank to think about how they can contribute to deploying the funds of major emerging markets rather than lending to major emerging markets. More ambitious than simply providing surveillance and monitoring that would support most ambitious investments by emerging markets would be the creation of an international facility in which countries could invest their excess reserves without taking domestic political responsibility for the process of investment decision and ultimate result.

If such a facility was able to attract even a limited fraction of excess reserves and to charge even a relatively modest fee, the sums of money available to support the concessional and grant aspects of global development would be significant. For example, globalizing $500 billion at a fee of 100 basis points would produce $5 billion a year that could go towards global public goods, multilateral grant assistance or debt relief.

There are many problems here. As we have found with state pension funds in the United States any large investor cannot completely escape political issues. There is the question of how central bank profit contributions to government budgets should be handled when returns vary. There are issues of assuring integrity. I don’t minimize any of these difficulties, which might prove insuperable.

But it is an irony of our times that the majority of the world’s poorest people now live in countries with vast international financial reserves. The problem for these countries is not being supported in borrowing from abroad – and so it seems appropriate that some part of the focus of the international financial architecture move towards the challenge of deploying their large reserves as effectively as possible.

Conclusion

Just as India’s remarkable development over the last 15 years comes with both great opportunities and challenges, so too the dramatic changes in the pattern of global capital flows come with remarkable challenges and opportunities. I don’t think any of us have the answers. I will have served my purpose today if I have induced you to reflect on the future of a global economy increasingly defined by a large flow of official lending from developing nations to the world’s largest and richest economy.

Thank you.

Table 1.

| Excess Reserves Beyond Greenspan-Guidotti Rule Country | Excess Reserves (millions of US$, Q3 2005)) | Excess Reserves as a % of 2004 GDP |

| China | 724,080 | 41% |

| Taiwan | 210,134 | 69% |

| Korea | 136,711 | 18% |

| Russia | 118,154 | 20% |

| India | 107,703 | 15% |

| Malaysia | 58,613 | 50% |

| Algeria | 50,518 | 60% |

| Mexico | 47,083 | 7% |

| Thailand | 35,489 | 21% |

| Saudi Arabia | 73,897 | 29% |

Figure 1

Figure 2

Source: Brad Setser and Sangeetha Ramaswamy, “RGE Global Reserve Watch”, March 2006

Figure 3

Figure 4

Figure 5

Figure 6

1 http://www.rgemonitor.com/blog/setser

2 For a fuller treatment of these discussions see my Per Jacobson lecture (2004).

3 Corrado, Hulten and Sichel, “Intangible Capital and Economic Growth”, NBER Working Paper 11948

4 Dani Rodrik has powerfully made essentially this point, though he focuses on countries’ international borrowing costs rather than their potential social gain from investing reserves.